In today's rapidly evolving business landscape, the Chief Financial Officers (CFOs) role has expanded beyond traditional financial oversight. Successful CFOs are strategic leaders who drive growth, ensure compliance, and optimise organisational structures. To uncover the secrets of their success, Sage surveyed 1,200 Finance Leaders, 75% male and 25% female. This blog post delves into the key traits identified in this research.

1. Strategic Vision

A successful

CFO must align financial strategies with the company’s long-term goals. This involves understanding market trends, industry shifts and the competitive landscape. Engaging in strategic planning helps CFO’s anticipate challenges and capitalise on opportunities. 60% of the CFO’s surveyed by

Sage foresee a future where their insights will increasingly influence company strategy. It was also found that finance leaders spend over 4 hours a day on average on tasks outside of traditional finance activities.

2. Data-driven decision making

Data analytics is crucial. CFOs should invest in robust financial systems that provide real-time insights. This allows for informed decision making, improving efficiency and supporting strategic initiatives. 81% of finance leaders surveyed acknowledged that automation frees them up for more strategic initiatives. 61% are preparing to spend more time in financial reporting and analysis and an equal percentage in financial and scenario planning.

3. Effective Communication

CFOs need to communicate financial concepts clearly to people within the organisation that might not have a financial background. Building relationships with other executives, board members and employees creates a collaborative working environment, ensuring that financial objectives align with wider business goals.

4. Risk Management

Identifying and mitigating risks is a core responsibility. Successful CFOs develop comprehensive risk management frameworks that cover financial, operational and regulatory risks ensuring that the business remains resilient in every environment.

5. Technological Savvy

Staying up to date and aware of financial technology trends is essential. Implementing tools such as AI and machine learning can streamline processes and enhance decision making capabilities. Embracing digital transformation is key to maintaining a competitive edge.

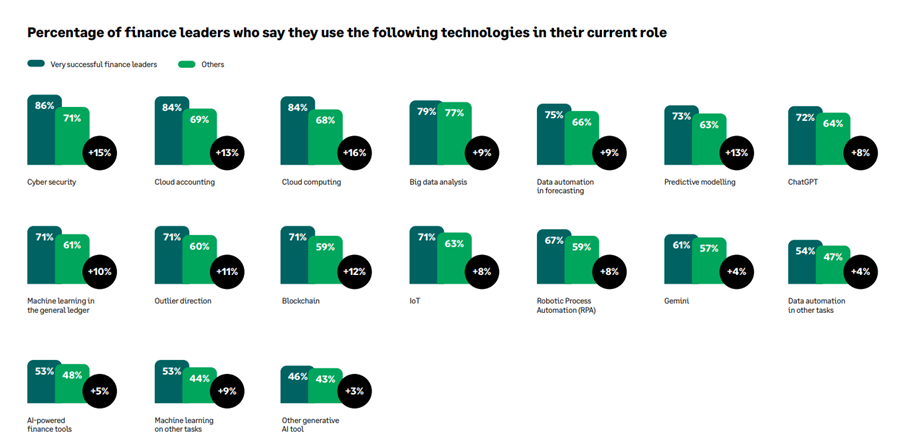

78% of CFOs emphasise the importance of staying current in technological advancements and believe it to be key to success over the next few years.

The graph below shows the percentage of finance leaders who say they use the following technologies in their current role:

6. Talent Development

A great CFO recognises the importance of nurturing talent within the finance team. By investing in training and development, CFOs build a skilled workforce that can adapt to changing demands and drive innovation. In a world where change is constant, the CFOs who thrive are those who adapt, innovate and lead with empathy and insight.

7. Sustainability and Social Responsibility

Today’s CFOs are increasingly tasked with integrating sustainability into the business model. This includes measuring environmental impact, managing resources efficiently and contributing to social responsibility initiatives which can enhance brand reputation and trust.

8. Continuous Learning

The business world is dynamic and continuous learning is essential for success. CFOs should seek out professional development opportunities, network with other CFOs and stay informed with industry best practices to remain effective leaders. 82% of finance leaders surveyed are motivated by their own success.

9. Collaboration Across Departments

Successful CFOs work closely with other departments, such as operations, marketing and HR to understand their financial needs and challenges. This collaborative approach fosters a holistic view of the business and supports informed decision making.

10. Agility and Adaptability

Finally, the ability to adapt quickly to change is crucial. Whether its responding to market disruptions or evolving with technology, successful CFOs embrace flexibility in their strategies and operations.

In this ever-changing business climate with lots of variation within the role it is extremely important to have business systems in place that are integrated, produce meaningful data and are reliable.

What solutions do we recommend?

We recommend

Sage 200, a comprehensive business management solution ideal for small and medium-sized enterprises. Its intuitive design, automated processes, and built-in customisation tools streamline sales, inventory, manufacturing, finance, and cash flow management without the complexity of a bespoke ERP.

Sage 200 grants freedom of choice; supported by a network of Business Partners with many deployment methods.

- Manage your data wherever you are

- A business wide software solution

- Fast return on investment

- Get up and running quickly and easily

- Boost your productivity – analyse your data with already formatted, neatly presented data within a single click with the comforting environment of Excel

- Integration with Microsoft PowerBI – a connection that allows all raw Sage 200 data to feed into the largest business intelligence cloud in the world

Having a solution such as Sage 200 ensures you can trust the data and know that your business is in the hands of a robust platform that thousands of businesses use everyday.

What makes Onesys different?

There are many Sage Business Partners to choose from. Why would a business choose Onesys?

- The relationship we have with our customers is always at the front of our minds and there are no hidden costs in our contracts

- Internal development team – giving flexibility to our customers to bridge any functional gaps without the need for additional software

- Customer Success Manager – working alongside our Account Managers and there to offer assistance between Support and paid for consultancy

- You’re not just a number to us – our business size means we’re big enough to deliver and small enough to care

CFO’s time is more limited than ever with the extra responsibilities that come with the job.

You can trust Sage 200 and you can trust Onesys.

The role of the CFO is more critical than ever, requiring a blend of financial expertise, strategic thinking and leadership skills. By focusing on these areas, CFOs can not only navigate the complexities of their role but also drive their organisations toward sustainable growth and success. Embracing these secrets can position any CFO as a vital asset to their organisation.

Speak to our team on 01423 330335 Option 1 or by emailing info@onesys.co.uk to discuss how we can help give you more time to spend on the above by having integrated systems that you trust.